How can exhibition organizers and companies use the data from the Global Exhibition Barometer? The bi-annual flagship research study by UFI, the Global Association of the Exhibition Industry, provides insights and key metrics on recovery rates, actual revenues and growth projections that you can use to benchmark to your show to your peers and colleagues. The best part: It’s free to UFI members and non-members.

In addition to a global perspective, the UFI Barometer provides a deeper dive into the data for North America. I outlined four key takeaways in this blog, UFI BAROMETER DEEP DIVE: U.S. IS BOUNCING BACK FASTER THAN GLOBAL INDUSTRY OVERALL, which was published on TSNN in August. There was so much great intel in this report, I wanted to share four more key takeaways:

The good news:

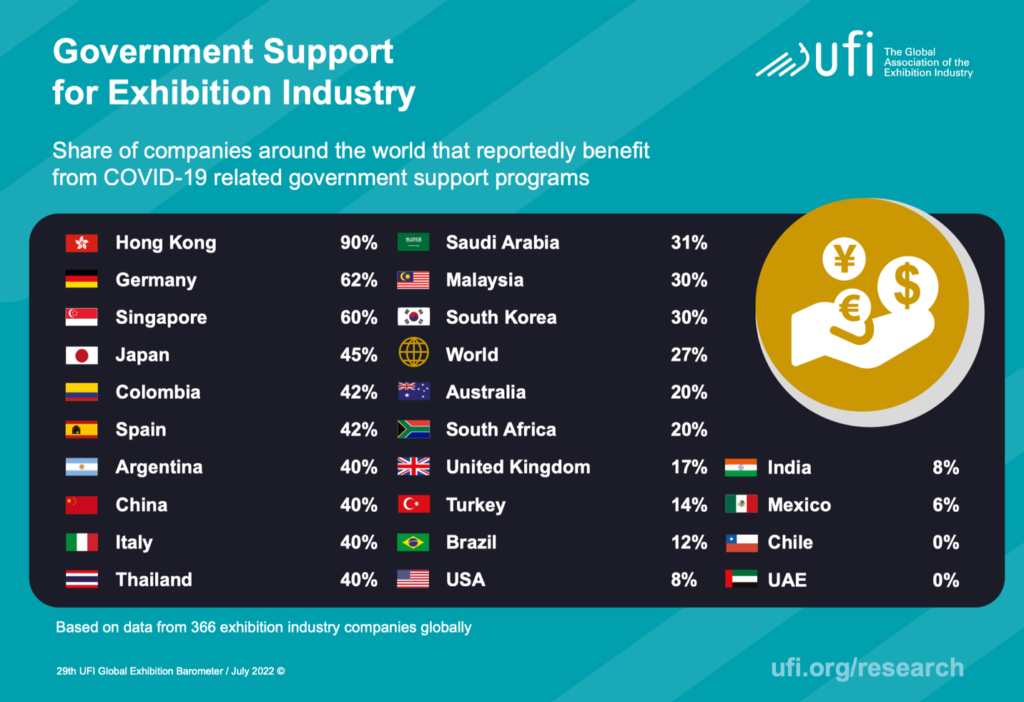

Survival without subsidies. Only 8% of U.S. exhibition organizations received Covid-19 related government support. Overall globally, 27% of exhibition companies received public financial support during the pandemic.

- Deeper dive: There were a total of 8,184 U.S. businesses in the Convention and Trade Show Organizers industry that received PPP (paycheck protection program) loans, according to the Small Business Administration. They received an average of $79,406 per loan and a total of $650 million, as of Dec. 2020.

Digital expansion. More than half (63%) of North American exhibition organizations added digital products and services (like apps, digital advertising and digital signage) around their existing events. Even more telling: 44% of North American exhibition organizations launched digital products and services not related directly to existing events. Here’s a sampling of digital offerings by the industry’s leading public companies:

- 90+% of RX Global’s 7 million annual attendees use its online exhibitor directories to find new products and suppliers. Mercury, RX’s registration system, uses attendee data and AI to recommend exhibitors to visitors based on the products and solutions they are searching for, according to data from RX Global Customer Mindset Tracker.

- Emerald is reporting growth: “One area that we are particularly excited about is the build out of our 365-day content platform which is delivering accelerated growth as we share best practices and launch new advertising and sponsorship offerings across our verticals,” said Emerald CFO David Doft in May. “We are also pleased with our ecommerce platform, Elastic, which has provided new customer signings and a subscription-based revenue stream to our business.”

The biggest challenges

International attendees and exhibitors. In H1 2022, travel restrictions and policies impacted international exhibitions, with 22% of North American exhibition companies reporting their cities were not open to international events. Keep in mind: The U.S. didn’t drop Covid-19 testing for international visitors until June 13 — a little over one month ago. After intense lobbying and advocacy by the airline, travel and exhibition industries, the U.S. rescinded a 17-month-old requirement that people arriving in the country by air test negative for Covid-19. Be patient: It will take time to reverse course and recover fully, but the numbers are ramping up quickly due to pent-up demand.

- According to a forecast from US Travel in June: International inbound travel is making strides toward recovery, aided by the recent repeal of the inbound pre-departure testing requirement. The sector is projected to grow rapidly through the rest of 2022, and then grow at a slower pace in 2023-2026. A full recovery to pre-pandemic levels (volume and spending) is not expected until 2025. However, policy changes can also help accelerate that timeline. If the U.S. reduces wait times for visitor visa interviews to less than 30 days, the U.S. could gain an additional 2.2 million international visitors and $5.2 billion in spending by the end of the 2022. U.S. Travel has several policy proposals to restore visa processing operations worldwide. The full US Travel report can be found here. Compared to 2019, key metrics in 2022: 67% of international volume, 53.3 million international arrivals (79.4 in 2019), $109 billion in international travel spending ($181B in 2019).

State of the economy. While the exhibition industry is benefiting from venue reopenings and improved travel policies, inflation, supply chain issues, rising fuel costs and the war in Ukraine are all impacting economic development for the global and North American markets. In fact, 15% of North American exhibition organizations report the state of the economy in the home market is the most important business issue in the exhibition industry, while 13% say it’s global economic development. Leading publicly traded exhibition companies are also citing these confirms in their outlooks:

- In July, Informa PLC reported: “We continue to closely monitor macro trends (inflation, energy prices, cost of living) and geo-political developments, however, … forward bookings for Live and On-Demand Events and forward commitments for specialist B2B Digital Services (remain strong).”

- In May, Hyve Group plc reported 2022 interim financials. Mark Shashoua, CEO of Hyve Group plc, commented: “We expect the strong momentum we have seen in the first half of the year to continue. Our in-person events are recovering faster than anticipated, with many having already fully recovered. Whilst there are clearly global economic and geopolitical headwinds, the Group is in a strong position with renewed confidence. This will serve Hyve well when navigating through any potential challenges.”

What has been your company’s experience? Please share your best practices with the industry in the comments.

In line with UFI’s objective to provide vital data and best practices to the entire exhibition industry, the full results can be downloaded at www.ufi.org/research. The next UFI Global Exhibition Barometer survey will be conducted in December 2022.

Leave A Comment